Fuminori Yoshida remarks

Announcement regarding delisting grace period on TSE website

Opinion of Fuminori Yoshida Representative Director and CEO of SymBio Pharmaceuticals

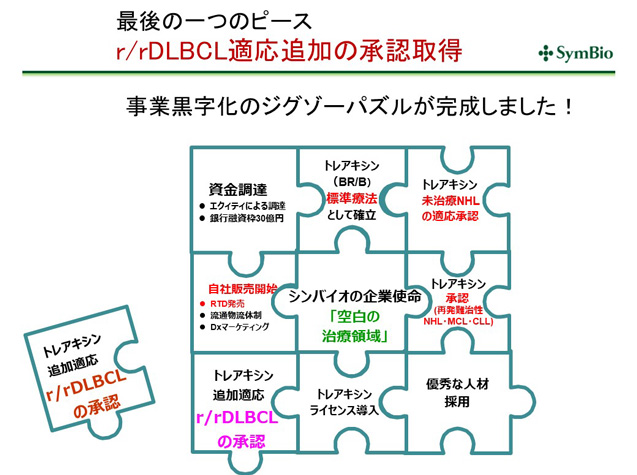

On Wednesday, March 24, just after 2:00 p.m., it was announced on the Tokyo Stock Exchange website during the market that the Company would enter a grace period for delisting. With only a short amount of time left before the end of the afternoon session, the market did not have time to think calmly, resulting in a lower stop price. The day before, we received approval from the Ministry of Health, Labor and Welfare for relapsed/refractory DLBCL, which is the most important factor for our business to turn profitable. We have just achieved the highest market capitalization since our founding, and I take this situation very seriously. It is very unfortunate that the acquisition of DLBCL approval caused excessive investor anxiety at the very moment when the business value was being reflected in the market capitalization.

We believe that this announcement by the TSE has not been fully understood by investors, and we would like to ask investors to understand the following two points regarding the content disclosed by the TSE.

- The delisting criteria will be reviewed and lifted due to the system revision scheduled by the Tokyo Stock Exchange in April next year.

- The earnings forecast for the current fiscal year is as announced, and there is no change to the forecast for profitability.

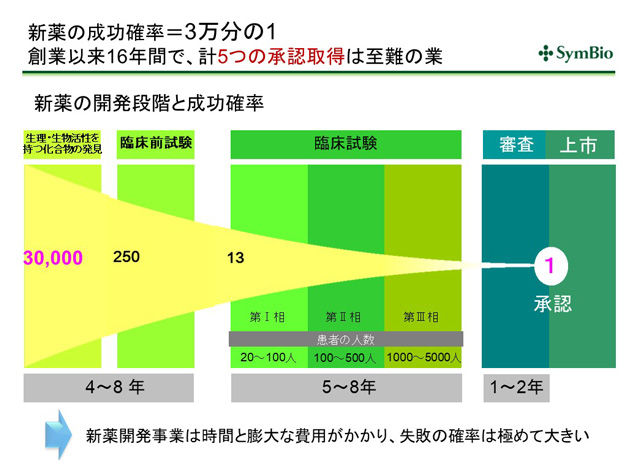

Since its founding, SymBio Pharmaceuticals has obtained approval for one new drug, and since then has continued to make management efforts to expand its indications. As a result, the probability of achieving the medium-term management plan and the full-year earnings forecast for this fiscal year has increased, and there are no changes at this time. There are no changes to our most important issues for the current fiscal year, namely to make the business profitable and to expand the global development of brincidofovir.

The NASDAQ market in the United States, which has created biotech companies such as Amgen and Biogen that are now expanding globally, has a good understanding of bioventure companies, and is a stock market that is remarkably superior for bioventure companies, including the amount of funds they can raise. Unlike the current delisting criteria of the Tokyo Stock Exchange, there is no time limit for becoming profitable, and the management of bioventure companies can concentrate on research and development. For that reason, there are global bio-venture companies that have been listed on the stock exchange for more than 20 years, have succeeded in developing new drugs, become profitable, and are now worth more than 2 trillion yen.

According to the announcement of the Tokyo Stock Exchange, the delisting criteria that require companies to become profitable will be abolished due to the system revision in April next year. I hope that under the new system, in Japan as well, the soil will be formed in which many bio-venture companies will be produced in the future.

I have attached the slides shown at the General Meeting of Shareholders below for your reference.

March 25, 2021

Representative Director President and CEO

Fuminori Yoshida